Neil Patel is notorious for ripping off other people's articles and calling them his own.

I can't say I've watched much on Youtube but for SEO articles Brian Dean is good at distilling topics into easy to digest chunks so I'd expect his Youtube channel to be pretty good: www.youtube.com/user/backlinko

Less sure what you're looking for on broader digital marketing - are you looking for email marketing, pay per click advertising, marketing automation..?

Thanks Johnny - I'm looking for all kinds of things really but I suppose SEO and email marketing to begin with.

Right now I'm mainly listening to:

- TropicalMBA

- Startups for the rest of us

- Rogue Startups

- Art of Product is new to me and quite enjoying it

- UI Breakfast depending on the guest

Early Stage Founder looks interesting, but I can't remember having listened to it yet!

Though to be honest while I really enjoy podcasts I find I want to concentrate on them, so with no commute etc it's quite hard to find the time!

Mailshake gets rave reviews from people I know doing lots of cold outreach work

You can transfer to any of those countries, but in most cases you can only receive in the relevant currency of that country. EG Switzerland can receive CHF, UK can receive EUR and GBP etc.

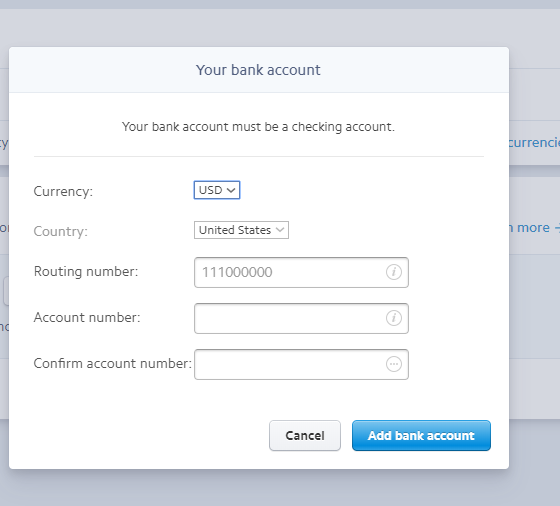

So to choose USD you have to choose 'United States' as the country - there's no option for Denmark where Revolut bank. Which means you need a US account number not IBAN, which fortunately Transferwise provide - here's a screenshot of the screen on stripe

Unfortunately that doesn't work, as Stripe will only pay USD to a US account for some reason.

Instead I set up a Transferwise Borderless account which has no monthly fee but a small (0.5%?) fee when you convert currencies. This is based in the US and has the ACH number and routing codes you need for Stripe. It works well for receiving funds but feels less like a complete bank alternative.

One issue I've noticed with both is that while I now have the freedom to choose when to exchange from USD<>GBP and potentially could benefit from better exchange rates, it means I get distracted by exchange rates and Brexit news trying to time my transfers for a better rate. This sometimes messes with my productivity, as I tend to hoard usd until I need GBP and then get anxious about whether I should change now or later...

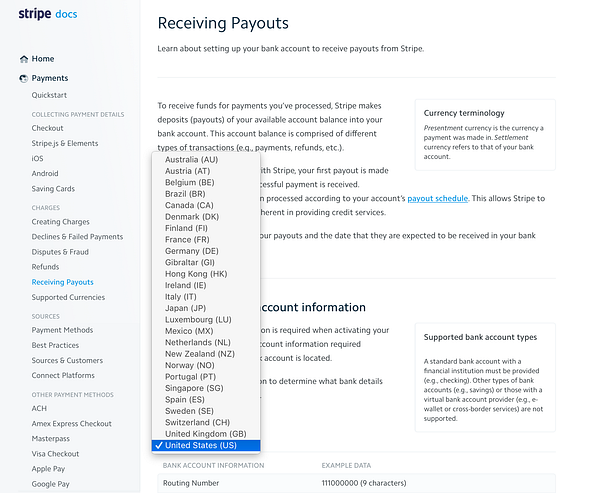

Oh... that's strange. The payout doc (stripe.com/docs/payouts#suppo…) seem to indicate that it is possible to transfer proceeds to any bank that's a in country where Stripe operate (see attachment).

The reason i'm asking is because the same doc says:

Supported bank account types

A standard bank account with a financial institution must be provided (e.g., checking). Other types of bank accounts (e.g., savings) or those with a virtual bank account provider (e.g., e-wallet or cross-border services) are not supported.

I'm wondering which category Revolut falls into ...🤔

You can transfer to any of those countries, but in most cases you can only receive in the relevant currency of that country. EG Switzerland can receive CHF, UK can receive EUR and GBP etc.

So to choose USD you have to choose 'United States' as the country - there's no option for Denmark where Revolut bank. Which means you need a US account number not IBAN, which fortunately Transferwise provide - here's a screenshot of the screen on stripe

I think the biggest trick with discounts is not to make them predictable. If you run spring / autumn promotions people will wait to buy as they know it's coming, so its definitely a good idea from that POV.

Plus it's fun, human and an extra feelgood factor to celebrate. I saw Justin Jackson is doing a sale for his birthday which I think's great too - you're basically giving yourself a nice present on that day :)

I'm using revolut business as I was paying enough in FX fees that the switch saved money rather than costing more. I don't use it as my only bank (tho I guess there's no reason I shouldn't now) but just to receive USD and convert to GBP.

It works really well and due to the monthly there is 0 fees. My biggest frustration is their login verifications can be slow (likely as much due to my setup as theirs) so by the time I receive them the session has tined out and I have to start again. Otherwise all is quick and efficient - transfers between currency accounts are instant and a withdrawal hits my account within an hour.

One slighly weird quirk is a lot of automatic IBAN / SWIFT verification systems think their codes are invalid, so I've had people refuse to pay to that account as their systems won't allow it - but those that have submitted pyament anyway have been paid in with no issues.

I don't use their virtual or real cards yet but looks cool. Might try them out if I get some freelancers who need expenses.

Thanks for sharing Jonny 🙌 Seems to be a solid alternative to old banks!

Have you tried withdrawing Stripe funds toward your Revolut Business account?

Unfortunately that doesn't work, as Stripe will only pay USD to a US account for some reason.

Instead I set up a Transferwise Borderless account which has no monthly fee but a small (0.5%?) fee when you convert currencies. This is based in the US and has the ACH number and routing codes you need for Stripe. It works well for receiving funds but feels less like a complete bank alternative.

One issue I've noticed with both is that while I now have the freedom to choose when to exchange from USD<>GBP and potentially could benefit from better exchange rates, it means I get distracted by exchange rates and Brexit news trying to time my transfers for a better rate. This sometimes messes with my productivity, as I tend to hoard usd until I need GBP and then get anxious about whether I should change now or later...

Oh... that's strange. The payout doc (stripe.com/docs/payouts#suppo…) seem to indicate that it is possible to transfer proceeds to any bank that's a in country where Stripe operate (see attachment).

The reason i'm asking is because the same doc says:

Supported bank account types

A standard bank account with a financial institution must be provided (e.g., checking). Other types of bank accounts (e.g., savings) or those with a virtual bank account provider (e.g., e-wallet or cross-border services) are not supported.

I'm wondering which category Revolut falls into ...🤔

You can transfer to any of those countries, but in most cases you can only receive in the relevant currency of that country. EG Switzerland can receive CHF, UK can receive EUR and GBP etc.

So to choose USD you have to choose 'United States' as the country - there's no option for Denmark where Revolut bank. Which means you need a US account number not IBAN, which fortunately Transferwise provide - here's a screenshot of the screen on stripe

As a teenager in 2001 I discovered 'nomorehits', a traffic exchange where you got traffic to your site by visiting other members' sites.

It was pretty dull, so I made a bot in Visual Basic to spawn multiple IE instances and auto surf the sites. I then realised the traffic (and my own site!) was worthless, so I changed my URL to an affiliate link for an online marketing course and started earning commissions. Someone later signed up as my sub-affiliate and I was still receiving occasional $1 cheques from their efforts about ten years later!

I've always avoided Google Analytics from sheer paranoia they're going to eat my affiliate sites.

I've not looked at Matomo/piwik in years but I'd be very surprised if session analytics isn't in there somewhere, its just a confusing UI. But I've been very happy with Clicky.com for small websites, which will let you see individual user's paths (though not in aggregate), track goals, campaigns etc, and I've also been playing more with Mixpanel on larger event driven sites. I think we need more options, and hopefully this backlash will lead to more choice, but for now I'm pretty happy with one simple option and one that is above my needs.

The domain is quite important :)

By switching to .co.uk you will likely filter a lot of non UK traffic from seeing your site in Google. This could be a good or bad thing depending on your perspective. Simply moving to a UK IP can have a similar though less pronounced impact.

A 301 redirect will transfer the trust you've built up eventually, but Google have deliberately made them unpredictable and random to deter spammers. A recent thread on twitter had a bunch of professional SEOs griping that their client's migrations were taking literally months to take place and the sites to return to their former glories. So if you do it, be prepared to lose search traffic for some time.

Is there a particular reason you feel you need to redirect?

Hi,well it's early days so probably better to switch now. My interns site is UK focused so some people said "make it .co.uk"